While the request might be approved the same day, it might take up to 5 business days for the money to reach the recipient.

Fill up and submit the wire transfer form, which can be done online or offline.This includes the company’s own bank account number and the recipient’s name, contact details, bank account number, and SWIFT code. This choice usually depends on how fast the institution can wire the money, what their charges are, and how easy the process is. Choose a financial institution to facilitate the transfer.Let’s say a company with a global footprint needs to make an urgent overseas bank transfer. It allows transactions of up to SGD 200,000 at a time, subject to the customer’s daily or monthly withdrawal limits.

#WIRE TRANSFER TIME CODE#

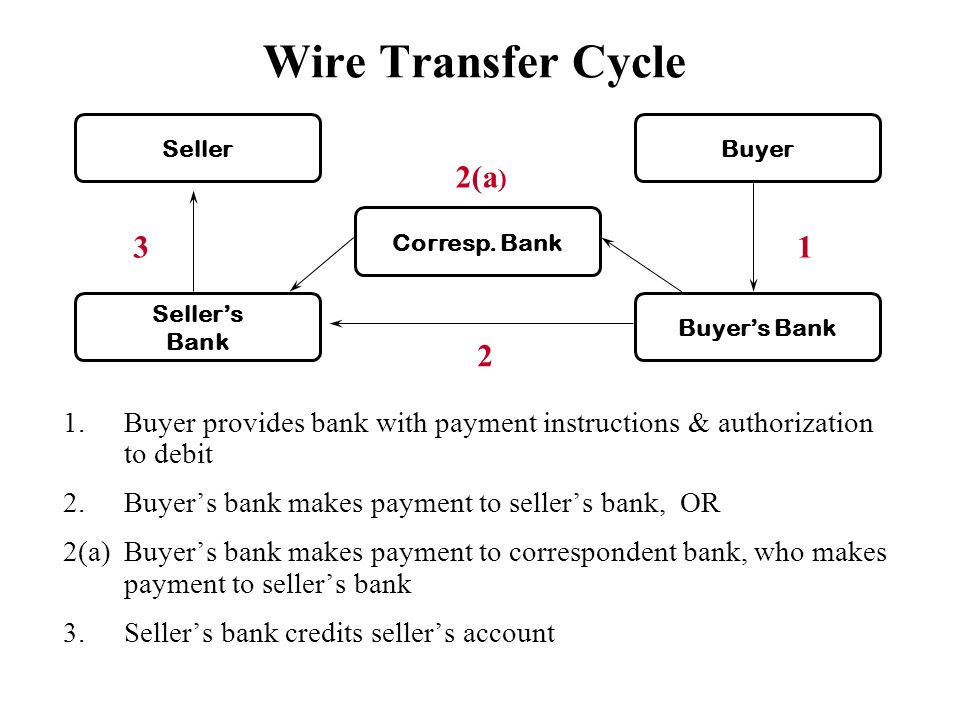

This is called the Business Identifier Code (BIC), commonly referred to as the SWIFT code.Īs for FAST, it is an electronic money transfer service in Singapore that helps customers of its member banks and non-bank financial institutions move funds locally in Singaporean dollars almost instantly, seven days a week and 24 hours a day (though this might be subject to the specific timings of financial institutions). Organisations that use SWIFT are assigned a unique code with eight or 11 characters. It counts 11,000 institutions across 200 countries as its members, making it a universally-accepted network for international wire transfers. The SWIFT network is a secure messaging service used by financial institutions to exchange information, including instructions for wire transfers. But how does it work? In a wire transfer, money moves between the financial institutions through networks such as the Society for Worldwide Interbank Financial Telecommunication (SWIFT) or Fast and Secure Transfers (FAST, which is Singapore-specific) among others. That takes care of what wire transfer is.

0 kommentar(er)

0 kommentar(er)